Welcome to this simple and straight forward guide on how to sell shares online in Nepal. In this article, we will provide detailed process and actionable steps to help you successfully sell your shares online.

This straight forward guide will provide you the knowledge on how you can sell shares through online platform in Nepal.

Understanding the Nepalese Stock Market Before to Sell Share Online in Nepal

Before understanding the scope of online stock trading, it is necessary to acquire basic knowledge of Nepali stock market.

Nepal Stock Exchange (NEPSE) is the main stock exchange of the country for buying and selling shares. The NEPSE platform facilitates investors to trade in listed company securities.

Before proceeding to the process of selling shares online, let's first have a thorough understanding of the Nepali online stock market.

Online stock markets eliminate the need for physical presence or dealing with traditional brokers by allowing investors to buy and sell shares on an electronic platform.

This practical and efficient approach has many advantages, including lower costs, faster transactions, and access to more investment opportunities.

Here are some simple steps to follow to sell share online in Nepal.

Step 1: Selecting a Reputable Online Trading Platform (TMS Account)

The first step towards selling shares online in Nepal is choosing an online trading platform means to choose broker. Right now, there are 50 share brokers in Nepal.

You can choose any one of them as a broker for share trading. Though there are other options to select trading platform such as stock dealers, you as a individual, have to choose one of the 50 brokers.

Now at this time there is only one trading system for all the share traders which is known as Trading Management System (TMS). This TMS is managed by Nepal Stock Exchange not by the brokers.

Step 2: Opening Broker Account Online for Share Trading

Once you have selected a suitable broker, the next step is to open an online trading account. This process involves filling out an application form, providing necessary identification documents and completing other necessary verification procedures. This all you can do through online.

To apply for broker account online, you have to open brokers's web portal with broker's code with "tms" prefix. For example, if you have choosen 52 numbered broker as your broker for share trading, you have to type the website address as follows: www.tms52.nepsetms.com.np.

Likewise, if you choose 58 broker, you have to type www.tms58.nepsetms.com.np. When you type the broker's web portal. You have to click on 'New Registration ...' for submitting online registration form.

Now you have to fill up the necessary information in different 5 stages like General Details, Address Details, Bank Details, Depository Details, Documents uploads and User Agreements.

Once you submit the requests with form filling up of necessary information, broker will review your details with supportive documents and approve your request with User Name/ Code and Password. You have to check your email for it.

If any of the necessary documents are missing during your registration submission request, you will not be able to get broker's response with Use Name/ Code and Password. Therefore, you should be very careful to submit all the necessary information and documents.

Documents Necessary for Online Broker's Account Registration

Scan copy of Citizenship Certificate: citizenship certificate is the mandatory document you have to upload. In case of Minor, you have to upload the birth certificate. This should be in JPG format.

Bank account detail: You have to fill up the bank account detail. Bank account is necessary for necessary payment transactions.

Demat Account Detail which is meroshare: You have to submit the meroshare detail when you apply for broker account opening. A screenshot of meroshare information page is necessary to upload.

Photo: You need to upload a digital photo. You can take a photo from your smart mobile too.

PAN: Permanent Account Number (PAN) should be submitted. You have to submit scan copy of your PAN in JPG format.

There are other documents necessary to upload which are not mandatory but optional.

Make sure to carefully review the terms and conditions associated with the account and familiarize yourself with the platform's trading tools and functionalities.

Step 3: How to Sell Share Online

Before selling your shares, it is essential to conduct in-depth market research to make right decisions. Analyze the performance of the shares you intend to sell, track market trends, and stay updated with the latest news and events that may impact the stock market.

Utilize various resources to analyse market such as financial news websites, company reports, and expert analysis to gain valuable insights into the market.

Once you decide to sell share online, you have to open your TMS account means broker account with provided User Name and Password. Your have to change the password once you get the password from your broker through email.

Keep in mind that you can sell shares online during the market opening time. Market opening time is 11 am to 3 pm as normal trading hour and 10:30 to 10:45 am as special session.

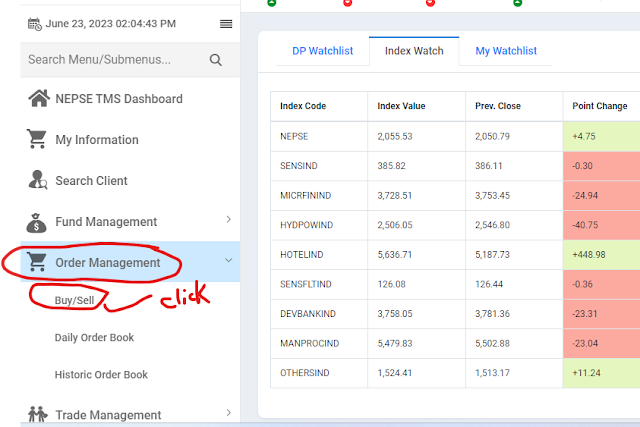

Once you open the broker account that is TMS account with provided user ID and password, you will see the TMS Main Dashboard. In the TMS Main Dashboard, you will see different menues. You go to the 'Order Management' menu and click.

Then you will different sub-menues. You have to go to Buy/Sell sub menu and click on that. You will see the interface in the desktop like as following:

In the interface, you have to select Sell button at the right up side corner as shown in the picture if you are going to sell shares.

Now you have to type your stock script in the 'Symbol' section. For example, if you have the share of stock Uniliver Nepal Limited, you have to type UNL in the symbol section because the symbol of Uniliver Nepal Limited is UNL.

When you type UNL in the symbol section, you will see the trading limitations such as high and low price you can offer, day low and high price and 52 week's low and high price etc.

In the following section, you will see the demand and supply situation of shares as 'buy orders and sell orders'.

Looking at the buy and sell orders in the following section and considering the buy/ sell price limit, you have to choose the selling price of your share.

Before finlizing the price you want to sell shares, you need to set the quantity of your shares that you want to sell.

When you put the share quantity and the price you want to sell, the 'Sell' button below will be highlighted. Click on the Sell button. It means you have placed the sell order.

If your selling order matches with the buying order, your sell order will be executed automatically. If the buyers are not ready to buy share in the price you have quoted, your sell order may not be executed.

It depends on the buyer's thinking to pay the price you have placed and the market trend. If the market trend is upside, there will be high chance to be executed your sell order.

If the market in in down trend, there may be low change of executing your sell order. In this case you may change or lower down the quote price of your order.

When the selling order and buying order matches, the trade will be executed. You can check your selling or buying order in the section of 'Daily Order Book'. Once you click on 'Daily Order Book' sub menu, you will see the status of your orders like whether it is in 'Open' or 'Completed' situation.

After executing the trade, you will receive email and sms from broker with trading details such as number of shares sold, the price per share and the total amount of your sold shares.

When your sell order is executed, then you have to do WACC calculation, Share Holding setup and EDIS (Transfering of shares) withing 2 working days.

When you complete all the necessary tasks after selling share as mentioned previously, you will get the payment of your trade from the broker within 3 days of your trade execution.

In this way, you can sell shares online in Nepal. Congratulations! You've now learned the essential steps to sell shares online in Nepal successfully.

.png)

0 Comments

Please do not put any spam links in the comment.